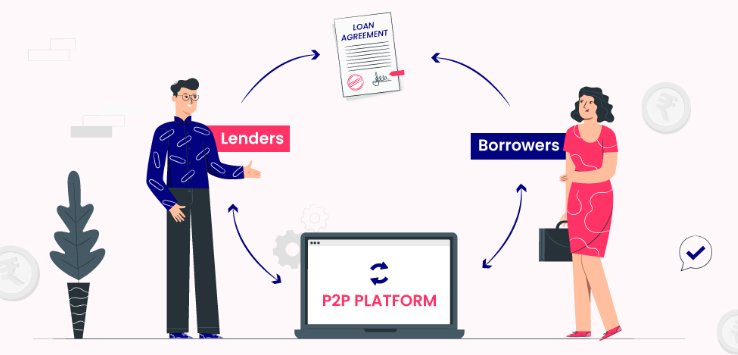

Over the past few years, the financial landscape in India has witnessed significant changes, with the rise of innovative fintech solutions that are revolutionizing the way people borrow and invest money. One such development is the growth of peer-to-peer (P2P) lending platforms, which have emerged as a popular alternative to traditional banking and lending institutions. P2P lending connects borrowers directly with investors, eliminating the need for intermediaries like banks and enabling faster, more accessible, and often more cost-effective financial services. This essay will explore the factors contributing to the rise of P2P lending in India, its impact on the Indian financial market, and the challenges and opportunities faced by this emerging industry.

What Is P2P?

Peer-to-peer (P2P) is a decentralized network architecture where individual nodes, or “peers,” in the network both contribute and consume resources. In a P2P network, each participant shares a part of their resources, such as computing power, storage, or bandwidth, which can then be accessed by other members of the network. This is in contrast to the traditional client-server model, where a central server provides resources to multiple clients.

P2P networks are used for a variety of applications, including file sharing, communication systems, content delivery, and distributed computing. Some popular examples of P2P networks and applications include BitTorrent for file sharing, Skype for communication, and Bitcoin for cryptocurrency transactions.

The main advantages of P2P networks are their scalability, fault tolerance, and resistance to censorship. Since there is no central point of control, P2P networks can grow organically and distribute resources more efficiently, making them more resilient to failures and attempts to disrupt the network. However, they also face challenges related to security, privacy, and legal issues, such as copyright infringement in the case of file sharing.

Why You Need P2P?

There are several reasons why you might need or choose to use a peer-to-peer (P2P) network:

- Decentralization: P2P networks distribute resources and responsibilities among participants, eliminating the need for a central authority or server. This reduces the risk of a single point of failure and makes the network more resilient to attacks or outages.

- Scalability: P2P networks can grow organically and handle increased demand more efficiently than traditional client-server models, as each new peer contributes resources to the network. This makes them more suitable for applications with a large or fluctuating number of users.

- Cost efficiency: By sharing resources among peers, P2P networks can reduce the need for expensive server infrastructure and bandwidth. Users can contribute their resources, making the network more cost-effective to operate and maintain.

- Improved performance: P2P networks can potentially offer better performance, especially in cases where network traffic is high or when there is a geographical distance between users. Data can be transferred directly between peers instead of passing through a central server, reducing latency and improving download speeds.

- Resistance to censorship: Due to their decentralized nature, P2P networks are more difficult to censor or control than centralized systems. This can be particularly useful for applications where freedom of speech or access to information is a concern.

- Privacy and security: In some P2P networks, users can maintain a greater degree of anonymity than in centralized systems. Encrypted connections and decentralized routing can provide additional layers of privacy and security.

- Community-driven: Many P2P networks are open-source projects driven by passionate communities, which can lead to rapid innovation, new features, and a sense of shared ownership among users.

However, it’s important to note that P2P networks also have potential downsides, such as increased security risks, privacy concerns, and legal issues. For example, file-sharing networks have been associated with copyright infringement, and some P2P applications can be used for malicious purposes. As with any technology, it’s essential to weigh the benefits and risks before deciding whether a P2P solution is appropriate for your needs.

How We Can Do P2P In India?

In India, you can use P2P networks and applications just like in any other country, provided you follow the local laws and regulations. Here are some steps to get started with P2P networks in India:

- Choose a P2P application or service: First, identify the type of P2P network you want to use, such as file sharing, communication, or cryptocurrency. Then, choose a specific application or service that meets your needs. Some popular P2P applications include BitTorrent for file sharing, Skype or Signal for communication, and Bitcoin or Ethereum for cryptocurrency transactions.

- Download and install the software: Visit the official website of the chosen P2P application to download the software. Be cautious about downloading from unofficial sources, as they may contain malware or be unreliable. Install the software following the provided instructions.

- Configure your settings: Most P2P applications allow you to configure settings such as bandwidth usage, storage allocation, and privacy options. Make sure to review and adjust these settings to suit your preferences and local regulations.

- Connect to the network: Once you have configured the software, you can connect to the P2P network and start using the service. In the case of file sharing, this may involve searching for and downloading files or sharing your files with others. For communication or cryptocurrency transactions, you may need to create an account or wallet and connect with other users.

- Use a VPN or proxy for added security: If you’re concerned about privacy or security, you may want to consider using a virtual private network (VPN) or a proxy server to help anonymize your connection and protect your identity. However, it’s essential to choose a reputable VPN provider and understand the limitations of these services.

- Follow local laws and regulations: Be aware of Indian laws and regulations regarding P2P networks and their usage, especially when it comes to file sharing and copyrighted material. Ensure that you do not participate in activities that may be considered illegal, such as sharing copyrighted content without permission or engaging in fraud.

- Stay updated: P2P technology and regulations can change over time, so it’s crucial to stay informed about updates to the software, new applications, and changes to local laws. This will help you continue using P2P networks in a safe and responsible manner.

Remember that using P2P networks comes with certain risks and responsibilities, so always ensure you are aware of the potential consequences and stay within the bounds of the law.

FAQ Regarding P2P Rise In Inida?

- What are the most popular P2P applications in India?

Some popular P2P applications in India include BitTorrent for file sharing, Skype and Signal for communication, and Bitcoin and Ethereum for cryptocurrency transactions. P2P lending platforms, such as Faircent, LendenClub, and IndiaMoneyMart, have also gained popularity in recent years.

- Is P2P file sharing legal in India?

P2P file sharing in itself is not illegal in India. However, sharing copyrighted material without the proper permissions or licenses is illegal and can lead to legal consequences. It’s essential to ensure that you’re only sharing and downloading legally available content when using P2P file-sharing networks.

- Are cryptocurrencies and P2P transactions legal in India?

As of my knowledge cutoff date in September 2021, cryptocurrencies are not banned in India, but their legal status is somewhat ambiguous. The Reserve Bank of India (RBI) had previously imposed restrictions on banks and financial institutions from dealing with cryptocurrency-related businesses, but the Supreme Court overturned this decision in 2020. However, the regulatory environment can change, so it’s crucial to stay informed about the latest developments and follow any applicable regulations.

- Are VPNs legal in India?

VPNs are legal to use in India, provided they are used for legitimate purposes. However, using a VPN to engage in illegal activities, such as accessing banned content, copyright infringement, or other criminal activities, is still illegal and can lead to legal consequences.

- How can I protect my privacy while using P2P networks in India?

To protect your privacy while using P2P networks, you can take several steps, such as using a VPN or proxy server, configuring your P2P application’s settings for optimal privacy, and being cautious about the information you share with others on the network.

- What are the risks associated with using P2P networks in India?

Some risks associated with using P2P networks include security threats, such as malware and hacking, privacy concerns, and potential legal issues, particularly when it comes to sharing copyrighted content without permission. It’s essential to be aware of these risks and take the necessary precautions to protect yourself and stay within the bounds of the law.

Conclusion

In conclusion, the rise of P2P lending in India is a testament to the transformative power of technology in the financial sector. Fueled by factors such as increased internet penetration, growing smartphone adoption, and supportive government policies, P2P lending platforms have successfully bridged the gap between borrowers and investors, offering a more transparent, efficient, and accessible mode of financing. However, the industry is not without its challenges, including regulatory hurdles, credit risk management, and the need to build trust among users. As P2P lending continues to grow and mature, it is crucial for stakeholders to address these challenges and work towards creating a robust, secure, and sustainable ecosystem that benefits both borrowers and investors. By doing so, P2P lending has the potential to significantly impact financial inclusion and contribute to India’s broader economic growth.